We are delighted to announce the successful integration with the Origo Dashboard Connector (ODC) as part of the UK Pensions Dashboard Programme (PDP).

Completed ahead of schedule, the integration reinforces our compliance and technological readiness, strengthening our position as a digital-first leader in the pensions industry. Connecting our pension schemes to the Pensions Dashboard was a vital step in meeting regulatory obligations and supporting greater transparency in pensions. The dashboard will empower UK consumers by giving them a secure, single view of all their pension information, helping them make informed decisions about their retirement planning.

Utilising a custom-built internal platform that eliminates the challenges posed by data silos, our platform enabled complex pension calculations and the provision of Estimated Retirement Income (ERI), all in compliance with technical data standards. The connection with Origo Dashboard Connector was a smooth technical project, backed by the long standing collaboration and mutual expertise. With Origo having already confirmed ODC operational acceptance with PDP, the connection process to the ecosystem for us at iPensions Group took just a few days to complete.

Hrishi Kulkarni, our Chief Technology Officer commented, “Technology is facilitating our compliance with regulatory requirements and enhancing operational efficiencies throughout the company. Leveraging our expertise and our relationship with Origo, we were able to swiftly adapt to the dashboard’s data requirements.

“Our readiness reflects a long-term vision,” said Hrishi Kulkarni. “Over the past 7–8 years, we have worked diligently to break down data silos, enhance data quality, and ensure our platform can handle complex pension calculations. Today, we are proud to say that our in-house, fully owned and developed pension platform is fully integrated with PDP standards.”

Origo shared its thoughts on the collaboration. Anthony Rafferty, CEO of Origo, comments: “It has been a pleasure working with iPensions Group and helping the company achieve its ‘connect by’ date. To be among the very first providers to connect is a fantastic achievement. It really showcases that it is possible for connection to occur quickly and smoothly.

“Origo is proud to have facilitated the connection and we’re looking forward to connecting more providers in the near future so millions of individuals will be able to benefit from the dashboards once they go live.”

We look forward to continuing our journey of excellence and innovation in the pensions sector, ensuring the best possible outcomes for all stakeholders involved.

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought (as well as legal advice where required) in both the UK and any jurisdiction where you are resident.

iPensions Group Limited is authorised and regulated by the Financial Conduct Authority, Licence Number 464521.

Nearly half of advisers believe SIPPs and pensions will benefit from Consumer Duty and advisers are cutting back on recommending high risk investments.

Our latest research* shows advisers are confident the implementation of new Consumer Duty rules will deliver on their key aim of boosting consumer retail investment with SIPPs – one of the key areas to benefit.

The study found nearly half (45%) of advisers believe the number of consumers taking out SIPPs will increase as a result of the launch of Consumer Duty rules from July 31st this year.

The boost to the numbers of customers will benefit retail investment products in general, the study found. Around two out of five (39%) believe the numbers of customers taking out retail investment products will increase while 61% believe pensions and retail investment products will benefit.

Just 14% questioned believe Consumer Duty will not boost the number of retail investors while 4% are unsure what the impact of the new rules will be.

Consumer Duty aims to increase consumer protection and promote fair practices in the financial services market requiring firms to act in good faith towards retail customers, avoid foreseeable harm, and enable and support customers to pursue their financial objectives.

Our research found the new rules are already having an impact on the products that advisers offer to clients. Around one in eight (12%) say they have stopped offering high risk investments as a result while 9% have withdrawn from offer defined benefit transfer advice.

iPensions Group Managing Director Craig Cheyne said: “A key aim of the Consumer Duty regime is to increase investment in retail investment products and advisers are confident it will deliver on that.

“Pensions in general and SIPPs in particular look likely to be major beneficiaries of the new rules and advisers are also reviewing the products they will offer to customers.

“We are focused on delivering transparent service in a timely manner and our innovative technology combined with decades of experience and expertise in UK and international pensions means we can offer a secure home for advisers looking to consolidate pension funds on behalf of clients.”

Here at iPensions Group, our growth strategy is driven by technology enabled products and solutions as we continue to deliver innovation in the SIPP market following significant investment in technology.

We offer a full range of SIPP services through the adviser market with our range of SIPPs including the Adviser SIPP, Platform SIPP, USA SIPP, and our Irish Transfer service.

* iPensions Group commissioned independent research company PureProfile to survey 100 advisers focused on pensions during April 2023 using an online methodology

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought (as well as legal advice where required) in both the UK and any jurisdiction where you are resident.

iPensions Group Limited is authorised and regulated by the Financial Conduct Authority, Licence Number 464521.

Our latest research* shows that spending on new technology is the biggest driver of increased investment by adviser firms ahead of the implementation of Consumer Duty rules, which will come into effect from 31st July 2023.

The study found that more than three out of four (76%) of firms have seen their costs rise as they prepare for the new rules, which aim to increase consumer protection and promote fair practices in the financial services market.

The increased investment in their businesses comes from a combination of one-off and ongoing costs, with 69% estimating that they are facing one-off costs, while 72% say the rise in costs will be permanent. Just one in six (16%) say that preparing for the implementation of Consumer Duty has had no impact on their cost base, while one in 12 (8%) were unclear about the financial impact on their businesses.

Investment in technology has had the biggest impact on costs – 67% highlighted spending on technology, while more than half (55%) say they have spent on improving their existing data. Just over one in three (34%) say they have invested in recruiting staff, while 38% have spent on segmenting customer databases.

There are some concerns that partner firms are not as well-advanced in preparing for Consumer Duty – around 38% say they are concerned about the issue. However, 59% are confident that partners are well-prepared.

The study asked advisers what the impact of Consumer Duty on charging will be, given that the Financial Conduct Authority’s expectation is that firms should provide fair value. Around a third (34%) of those questioned said advisers already offer fair value.

More hybrid charging is seen as the most likely outcome, with 58% of firms saying Consumer Duty will mean a range of charges for different services, while 56% expect it will lead to advisers revising fee structures. Just 43% believe it will lead to greater transparency.

Our Managing Director, Craig Cheyne, said: “Our study shows that adviser firms have invested heavily in preparation for Consumer Duty, underlining the commitment to its success from the industry.

“Clients are demanding increased use of technology, and that is reflected in the study, which shows that is the area which firms are addressing ahead of improvements to data.

“We are focused on delivering transparent service in a timely manner and have been investing in innovative technology to meet the demand from advisers and their clients.”

Our growth strategy is driven by technology-enabled products and solutions as we continue to deliver innovation in the SIPP market following significant investment in technology.

We offer a full range of SIPP services through the adviser market with our range of SIPPs, including the Adviser SIPP, Platform SIPP, USA SIPP, and our Irish Transfer service.

* iPensions Group commissioned independent research company PureProfile to survey 100 advisers focused on pensions during April 2023 using an online methodology

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought (as well as legal advice where required) in both the UK and any jurisdiction where you are resident.

iPensions Group Limited is authorised and regulated by the Financial Conduct Authority, Licence Number 464521.

Here at iPensions Group, we are further strengthening our support for mental health and wellbeing across the company as we continue to expand the business.

This week we are backing Mental Health Awareness Week, run by the Mental Health Foundation, with a series of events, workshops and sessions from May 15th 2023.

Support during Mental Health Awareness Week, which this year focuses on the theme of anxiety, includes yoga workshops on the importance of posture during the workday as well as sessions on building resilience and handling pressure in the workplace.

Alongside this week’s interactive sessions, staff are also competing with colleagues from different offices in a step marathon (Stepathon), encouraging an active lifestyle. The two-week Stepathon is already underway across the company and ends on May 22nd.

The Mental Health Awareness Week activities build on a range of support throughout the year which includes workshops on the links between lifestyle and mental and physical wellbeing as well as practical solutions and tips to integrate healthy habits into staff’s busy lives.

iPensions Group CEO Sandra Robertson said: “We place a high priority on supporting our staff with their mental health and general wellbeing as they are crucial to the success of our business and the maintenance of the highest possible levels of service for customers.

“Supporting Mental Health Awareness Week is just part of our expanding focus on wellbeing in the workplace.”

We have made significant investments in technology as part of our growth strategy, driven by a focus on innovation in the SIPP market as well as efficient and timely support for advisers and members.

Our growth strategy is driven by technology enabled products and solutions in the SIPP market where we offer a full range of SIPP services through the adviser market with our range of SIPPs including the Adviser SIPP, Platform SIPP, USA SIPP, and our Irish Transfer service.

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought (as well as legal advice where required) in both the UK and any jurisdiction where you are resident.

iPensions Group Limited is authorised and regulated by the Financial Conduct Authority, Licence Number 464521.

By Group CEO Sandra Robertson, iPensions Group

The UK economic outlook might be all about uncertainty in the year ahead, but the UK pensions industry can be certain that it has to adapt to a new round of regulation and technological advance while delivering in the face of ongoing challenges.

Inflation is on its way down with the latest figures showing Consumer Price Inflation at 10.7% following a peak of 11.1% but no one can be certain quite yet about its future path. There is a degree of certainty that interest rates will continue to rise and a growing consensus that the UK economy is heading into recession.

There is absolute certainty that consumers are feeling the pain of the cost-of-living crisis and it has had an effect on pension contributions. People are looking at their squeezed household budgets and thinking that stopping or reducing pension contributions might be a good idea.

Research from the Pensions and Lifetime Savings Association in October showed nearly one in five (19%) of schemes had received inquiries from members about stopping or reducing contributions. Around 17% reported inquiries from members wanting early access to pensions while just 28% said they had seen no changes in the behaviour of savers.

It’s an unsettling background for the pensions industry in common with the rest of the country but one which provides the perfect opportunity for the industry and providers to show leadership.

There has never been a time when leadership in the sector has been more important for helping to navigate the uncertainty and challenging times during the current financial climate while also delivering on the upcoming regulatory and industry issues.

Companies had to have implementation plans in place by the end of October 2022 for the new Consumer Duty regulations ahead of the first implementation by July 31st next year.

It is a development that the industry should embrace. Consumer Duty is potentially a huge opportunity for everyone in all business functions to think beyond simply delivering compliance with a rule book and take a holistic approach to ensuring customers receive good outcomes from their retirement savings. It should be a natural shift for providers, advisers, and trustees from treating customers fairly to treating customers well and being able to prove it.

The focus will now be on outcomes which inevitably involves a degree of interpretation. But it should enable advisers to demonstrate their value to customers while empowering advisers to adopt a new mindset. They will need to think like their customers and what they would want. It will drive up standards across the industry which is to be welcomed.

But it is not the only regulatory issue the industry will have to address. Pensions Dashboards are coming with the long-awaited Department of Work and Pensions initiative finally coming to life next year. They are a major step forward in the technological advances across the industry. The Dashboards will enable savers to access data on their pensions including the State Pension in one place online. That should transform how pensions are understood by retirement savers while introducing more consistent reporting and greater transparency.

It underlines the continued need for robust compliance and governance which emphasizes the need for industry leaders to get everyone on board with the vision but to be agile and continuously adapt where necessary.

The technology of Pensions Dashboards is coming to an industry which is already embracing technology with the support of strong adoption among advisers.

Digital solutions are vital to keeping people engaged with their pensions and will be an important tool in helping to minimise cancellations and the reduction of pension contributions. iPensions Group is one of a number of providers enabling customers to access their details online 24/7.

Ease of sign-up is just part of the solution – online portals enable customers to choose their preferred investment funds and monitor their performance online with complete transparency on fees and charges, with access to risk ratings and asset allocation information on their chosen funds.

Technology will not ease the economic uncertainty, but industry leaders have a duty to make pension saving as easy as possible. Delivering transparency, competitive charges and a wide investment choice allied to robust governance and compliance will help reduce the uncertainty in the year ahead.

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought (as well as legal advice where required) in both the UK and any jurisdiction where you are resident.

iPensions Group Limited is authorised and regulated by the Financial Conduct Authority, Licence Number 464521.

Our success depends on our people which is why we support, develop and recruit the best. As we continue to expand our business, we have also been investing in our teams by providing a range of support and guidance on wellbeing and nutrition.

Working with specialist consultants BetterBe to help optimise our investment in employee health, our people have been offered a range of workshops designed in a logical sequence to provide knowledge and understanding of the links between lifestyle and mental and physical wellbeing as well as practical solutions and tips to integrate healthy habits into their busy lives.

Isle of Man-based BetterBe, founded by GP Lukas Burri and nutritionist Lisa Burri, is also helping managers at iPensions Group to support behavioural change among our teams towards healthy habits aimed at supporting performance.

Group CEO Sandra Robertson said: “Our people are crucial to the company’s success and investing in their health is an important focus for the business as we continue to expand.

“We are focused on delivering transparent service in a timely manner for our customers and that requires investing in our employees and providing as much support as possible for them.”

Data shows investing in staff wellbeing pays dividends for company performance and customer service considering that underperformance at work costs UK companies around £4,000 per employee a year.

We have made significant investments in technology as part of our growth strategy, driven by a focus on innovation in the SIPP market as well as efficient and timely support for advisers and members.

Our growth strategy is driven by technology enabled products and solutions in the SIPP market where we offer a full range of SIPP services through the adviser market with a range of SIPPs including the Adviser SIPP, Platform SIPP, USA SIPP, and the Irish Transfer service.

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought (as well as legal advice where required) in both the UK and any jurisdiction where you are resident.

iPensions Group Limited is authorised and regulated by the Financial Conduct Authority, Licence Number 464521.

We are delighted to announce that we have recently completed the seamless migration of Forthplus SIPP customers ahead of schedule, integrating £500 million assets under administration.

We acquired the business assets of Edinburgh-based Forthplus Pensions, which was in administration, at the end of last year and initially expected to take at least six months to transfer the accounts of almost 2,500 customers.

However, the migration has been finalised faster than expected, giving former Forthplus advisers access to iPensions Group’s technology solution and enabling them to benefit from the enhanced adviser portal.

Advisers will be able to manage Forthplus SIPP clients via their existing adviser portal accounts and view up to date client information 24/7 from anywhere in the world.

Staff in Manchester and Edinburgh, where a new bigger office was opened in February, can now use the same technology which further improves services to members and advisers.

iPensions Group CEO Sandra Robertson said: “Delivering the migration seamlessly and ahead of schedule is a major achievement for the business and delivers on our promise to Forthplus SIPP members and staff.

“Integrating the new members, staff, and advisers into the iPensions Group has involved a lot of hard work and the successful outcome is a testament to our team and technology.

“iPensions Group is focused on delivering transparent service in a timely manner and our innovative technology combined with decades of experience and expertise in UK and international pensions means we can offer a secure home for their pensions.”

The acquisition of Forthplus Pensions builds on our growth strategy at here iPensions Group. Driven by technology enabled products and solutions, we continue to drive innovation in the SIPP market following significant investments in technology.

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought (as well as legal advice where required) in both the UK and any jurisdiction where you are resident.

iPensions Group Limited is authorised and regulated by the Financial Conduct Authority, Licence Number 464521.

Around one in three advisers say SIPP consolidation is increasing.

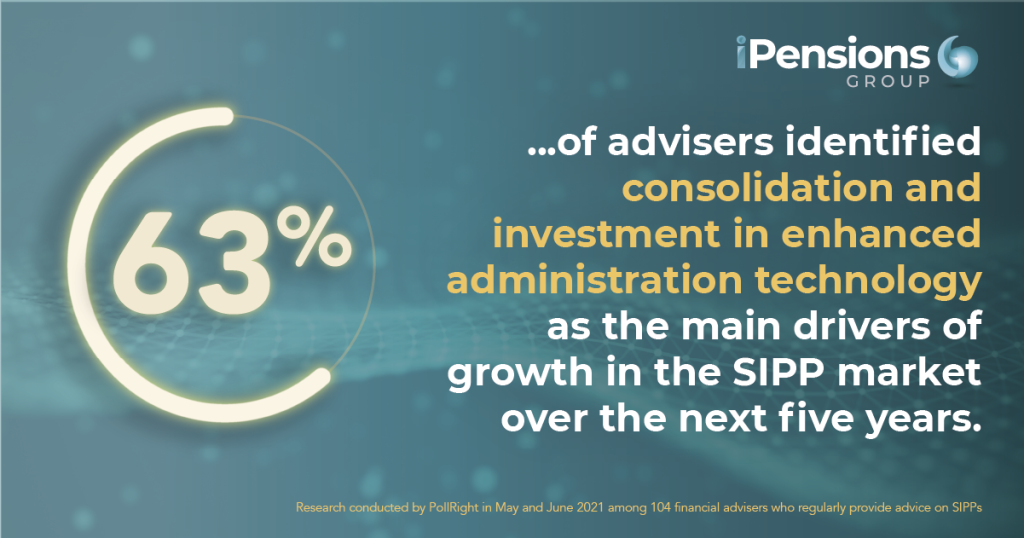

Our recent research shows that advisers believe pension consolidation and technology investment by providers will drive continuing expansion of the SIPP market.

Nearly two out of three (63%) of advisers identified consolidation and investment in enhanced administration technology as the main drivers of growth in the SIPP market over the next five years.

The role of improved administration technology is just as important as consolidation, the research shows, with around one in 10 (11%) expecting a significant rise in pension consolidation into SIPPs over the next two years.

Our study found consolidation of pensions by clients is already increasing – around a third (30%) of advisers reported an increase in demand for consolidation advice over the past year.

Less than half (44%) of advisers said transparent pricing by providers – long regarded as a major concern by advisers and clients – is crucial to the growth of the SIPP market while a quarter (26%) believe reduced fund management charges will boost the market.

Group CEO Sandra Robertson said: “Nearly a third of advisers specialising in SIPPs have seen an increase in consolidation business in the past year and they expect that to continue as a major factor in the market. Increased investment in technology across the SIPP market and the pensions market in general is driving growth and helping to enhance the consolidation process by supporting advisers and clients.

More needs to go online and happen digitally as people want instant information while also still valuing personal service and the key to supporting clients is combining that well with technology.”

The research found that the main reason cited by advisers for clients consolidating pensions into a SIPP was the desire to have a clearer picture of their assets as they approach retirement. Around 71% of advisers chose that option ahead of 62% saying concern about overall retirement strategy is driving the rise in consolidation.

More than half (55%) of advisers say the consolidation decision is driven by clients approaching 55 who want to access tax-free cash. However only 40% say worries about high charges from legacy pensions and the lack of fund choice is a major motivation for clients to consolidate.

Here at iPensions Group, we have made significant investments in technology as part of our growth strategy driven by a focus on innovation in the SIPP market as well as efficient and timely support for advisers and members.

Our bespoke technology platform, which was developed internally over three years, is enabling us to add new SIPP products such as the Platform SIPP and to develop new services for its advisers and members.

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought (as well as legal advice where required) in both the UK and any jurisdiction where you are resident.

iPensions Group Limited is authorised and regulated by the Financial Conduct Authority, Licence Number 464521.

We are delighted to announce the acquisition of the Forthplus Pensions book of business providing certainty to its 2,500-plus members.

The acquisition of the Edinburgh-based SIPP provider and administrator enables customers who include UK expats to transfer to a company with over two decades of experience in UK and international pensions and a commitment to the highest standards of personable service in the pensions market. Involving assets under management of around £500 million, the acquisition of the Forthplus SIPP builds on the growth strategy here at iPensions Group focused on technology-enabled products and solutions as we continue to drive innovation in the SIPP market.

Our Managing Director Craig Cheyne commented: “We empathise with Forthplus Pensions’ members and advisers and recognise that the past months must have been unsettling for them and staff. We look forward to supporting Forthplus Pensions members by continuing to provide our personable service and we welcome the expert administration staff at the company.

“iPensions Group is focused on delivering transparent service in a timely manner and our innovative technology combined with decades of experience and expertise in UK and international pensions means we can offer a secure home for their pensions.”

Our main office will remain based in Manchester and we are also retaining the Forthplus operations in Edinburgh together with its highly experienced administration staff.

We look forward to supporting all Forthplus members and advisers by continuing to provide our personable support and transparent service.

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought (as well as legal advice where required) in both the UK and any jurisdiction where you are resident.

iPensions Group Limited is authorised and regulated by the Financial Conduct Authority, Licence Number 464521.

UK IT Industry Awards recognise ‘transformational’ platform for advisers and clients

We’re thrilled to announce that we won the Best Financial Services IT Project of the Year Award for the launch of our transformational administration hub and adviser portal at the UK IT Industry Awards. It was ranked as the most outstanding financial services business project at the event held in London with the award based on the project outcomes for advisers and clients and not simply the technology.

Winning the award at the largest and most well-known event in the technology industry highlights the success of significant inhouse investment focused on innovation in the SIPP market to support advisers and their clients

Here at iPensions Group, we have built our own platform using leading-edge technology after evaluating other systems on the market and deciding they were not suitable and completed and launched it during the UK’s COVID-19 lockdown. The Manchester-based company won the award, which was decided following one-to-one interviews with expert judges, against competition from major companies including Brewin Dolphin, Nationwide, IBM, and IPC.

The highly scalable platform is underpinning ambitious growth plans for new product launches and is being regularly updated with new features and enhancements.

Hrishi Kulkarni, Director & Group Chief Technology Officer at iPensions Group, said: “We understand that client demand for accessing services online is transforming the industry with the impact of COVID-19 further accelerating the digital transformation in the pensions landscape.

“Our aim was to transform the business into one with best-in-class technology delivering unrivalled levels of service and we are excited to win the award which highlights the success of team work across the company involving technology experts and pension administrators.”

Our Adviser Portal enables advisers to complete the SIPP application process within minutes in contrast to days or weeks with paper-based applications.

Disclaimer

The content of this article is for general information purposes only and should not be construed as legal, financial or taxation advice. You should not rely on the information contained in this article as legal, financial or taxation advice. The content of this article is based on information currently available to us, and the current laws in force in the UK. The content does not take account of individual circumstances and may not reflect recent changes in the law since the date it was created. It is essential that detailed financial and tax advice should be sought (as well as legal advice where required) in both the UK and any jurisdiction where you are resident.

iPensions Group Limited is authorised and regulated by the Financial Conduct Authority, Licence Number 464521.